Three Unique Advantages

Clarity, Confidence & Direction

Amazing things can happen in your life when you have clarity, confidence and direction. Here are three unique tools that only Janiczek® offers.

-

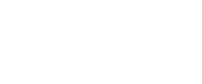

The Stages of Financial Freedom®

Your path on the Stages of Financial Freedom is critically important. Using this tool, we will pinpoint where you have been, where you are (including the current trajectory and velocity) and most importantly, where you want to go (your ideal future path forward) and zero into mitigating what's holding you back and putting in place what will help you progress forward with the greatest ease.

-

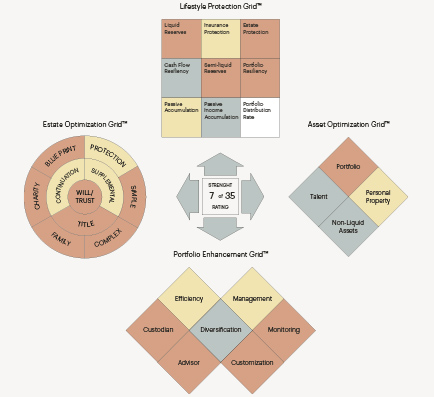

The Wealth Optimization Dashboard™

Financial strength is a great advantage. Financial strength can help you sleep better, invest better and live better. Financial weakness and vulnerability are the antithesis of each of these advantages.

An additional proprietary tool you will have access to as a client of Janiczek® is our Wealth Optimization Dashboard, complete with simple to understand green (financial strength), yellow (financial weakness) and red (financial vulnerability) ratings across 35 Essential Strengths®. This tool simply helps us pinpoint the actions that will advance you forward and build your financial strength, agility, flexibility and endurance where we believe it is needed most.

-

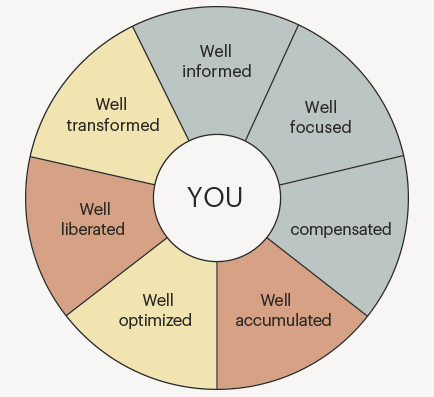

The Flourish! Model™

To flourish is to grow or develop in a healthy or vigorous way, especially as the result of a particularly favorable environment.* We’ve pinpointed seven traits, called Flourish! Activators™, which represent the short list of milestones, from practical to profound, we aim to help our clients reach in order to flourish at higher and higher levels. From being Well Informed, Well Focused, Well Compensated, Well Accumulated, Well Optimized, Well Liberated to Well Transformed, your journey as a client of Janiczek® will touch upon each one of these natural traits as we seek to help you and all of those around you to flourish. See Mr. Janiczek’s latest book, FLOURISH! How to Prosper with the Great Ease, for more details on this exciting dimension of our work.* The Oxford Dictionary