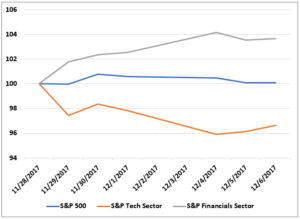

While the S&P 500 remained near its all-time high, the recent massive selloff in the technology sector went mostly unnoticed. But for investors who follow the so-called “FANG” stocks (Facebook, Amazon, Netflix, Google) the hit was painful: About $60 billion in value was wiped out in just one afternoon, representing the largest selloff in nearly 2 years.

The wipeout was a function of just how big these companies have become and the position they are in with new tax reform looming. Tech companies are expected to receive little benefit given its already-low average tax rate of 18.5% (below the 20% proposed rate).

Interestingly, the S&P 500 was relatively unaffected while this rotation into financials and out of tech ensued. The index’s volatility actually remained low, as did correlations among the S&P 500’s member stocks.

In other words, the diversity offered by the S&P 500 Index allowed for the index too remain relatively unscathed by the trading within the tech and financial sectors, a key reminder to investors that having proper exposure across the markets continues to be important with the S&P 500 near its all-time high.