01

What level of financial strength and vitality is really needed to enjoy a distinct advantage during such scary times?

Great question. It’s really all about enjoying a TRUE sense of financial security and independence versus a FALSE sense of financial security and independence. Here’s the difference:

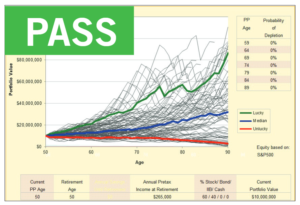

- A TRUE sense of financial security and independence is attained when you absolutely know your personal finances meet or exceed a stringent set of standards of excellence and pass a variety of extreme stress test scenarios. In short, you structure your balance sheet, cash flow, and investment portfolio, and in turn, yourself, to genuinely flourish through thick and thin.

- A FALSE sense of financial security and independence is one that falls short of specific scrutiny, standards and testing. In short, your balance sheet, cash flow, and investment portfolio, lack the strength, agility, flexibility and endurance (SAFE™ Ratings) to optimally function through thick and thin. In short, you struggle with a false confidence that can lead to poor decisions in good times and bad.

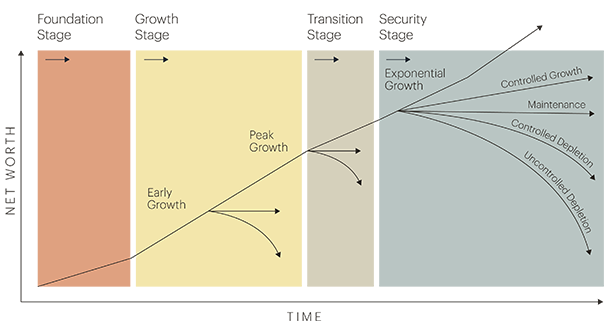

Our Stages of Financial Freedom® Roadmap is actually a great way to visualize and evaluate your financial journey and begin to understand what is working (strengths and advantages to build upon), and what is not (weaknesses and vulnerabilities to mitigate and/or eliminate). It’s also a great way to define what level of financial strength and vitality is really needed during your entire lifetime (including that of your surviving spouse, if married).

Stages of Financial Freedom®

Can you pinpoint where you are and what trajectory you have been on each decade in the past? Can you point out exactly what ideal and worst-case path you would like to be on into the future?

Our financial advisors have been using this tool with clients, prospective clients and attendees of seminars and webinars we teach, for decades. The typical goal we hear is to be on the controlled growth trajectory (or better) while maintaining a defined ($X per year) comfortable standard of living. The typical worst-case path (if one were to encounter an extremely poor economic period in the future) articulated is the maintenance mode. Rarely do we hear of a targeted or worst-case goal of controlled depletion. Of course, staying far away from the uncontrolled depletion path is desired by all.

Would it be safe to say your goal is to have the strength, agility, flexibility and endurance to journey through the Stages of Financial Freedom on an upward growth trajectory, easily able to maintain a comfortable standard of living, even through extremely challenging economic periods? In keeping with a philosophy of preparing for but not overemphasizing worst case scenarios, would it be fair to say your goal is to equally live the ups, downs and plateaus in an enjoyable and measured manner, making the most of each economic season (spring, summer, fall, winter and repeat) of life?

It’s All About Your Elastic Limit Wealth Threshold™

Elastic Limit is an engineering term that describes the amount of stress something can withstand before being irreparably damaged. Your Elastic Limit Wealth Threshold is our term for describing the amount of stress your finances can withstand before being irreparably damaged (on the path of uncontrolled depletion). Our belief is, the more precise guidance you receive to measure and strengthen your Elastic Limit Wealth Threshold, the better you can navigate the ups, downs and plateaus with poise.

Seeing this need, Janiczek Wealth Management created the discipline of Strength Based Wealth Management® and organized a set of tools, standards, services and routines aimed toward the end of building high levels of strength, agility, flexibility and endurance. In the process, we literally patented Systems and Methods for Optimizing Wealth.

It’s fairly easy to understand WHY to build financial strength. The rubber meets the road when you arrive at the HOW and the WHO. So, let’s move along to HOW and WHO.

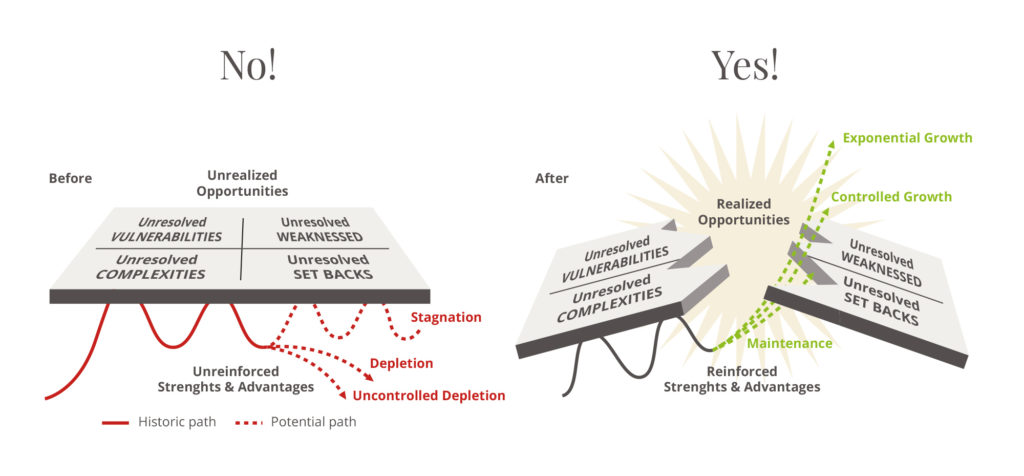

The Ceiling of Complexity is Likely Holding You Back – Here is How to Break Free

If we were to examine your finances, we would be able to zero into the strengths and advantages that helped you accumulate your wealth, as well as any weaknesses, vulnerabilities and/or setbacks that are hindering the trajectory of your path on the Stages of Financial Freedom. This is the art and science of Strength Based Wealth Management.

What we consistently see is those who lack the proper system, structure, support and discipline hitting a ceiling and tending to stagnate or deplete as a result. Conversely, those who are aided by the proper system, structure, support and disciplines being able to lever off of their SWOT (strengths, weaknesses, opportunities and threats) to learn and grow – even in harsh times – which sometimes offers the best lessons and opportunities.

It’s all about…

…converting unresolved vulnerabilities into resolved vulnerabilities.

…converting unresolved weaknesses into resolved weaknesses.

…converting unreinforced strengths into reinforced strengths.

…converting unresolved setbacks into resolved setbacks.

Our Top Ten Most Useful Tools for Building and Maintaining Financial Strength

With the aim of helping high and ultra-high net worth investors achieve these outcomes in a fraction of the time otherwise required, we created seamlessly blended a combination of tools, services and routines that are a natural part of our portfolio management, wealth management and retirement planning services. Here’s a synopsis of the top ten unique systems, tools and concepts only available at Janiczek Wealth Management:

A staple for decades, this proprietary visual tool and process, helps clients review (and learn from) their past, get clear about their present, and vividly articulate their ideal financial future. We know of no other financial planning tool that aids portfolio management, wealth management and retirement planning discussions and reviews in such an elegant, universally understood and articulated way. Overlaid with other more sophisticated analysis and tools, and interjected with new developments, such as recent advancements in longevity, this fundamental tool helps keep clients and trusted advisors from drifting away from top priorities and the big picture.

Modern-day financial management involves having instant access to accurate information on every aspect of your wealth and instant access to a support team equipped to help you. Enter J-Vault, a secure (encrypted and dual verification) desktop and mobile application that gives you access to up-to-date information on every aspect of your finances.

Check out these features:

- Instant secure access to your balance sheet, with the balances of banking, investment and even credit card accounts and mortgages automatically updated every 15-minutes.

- Instant secure access to all of your financial and personal records, such as insurance policy records, estate plan documents, passport copies, account numbers, and a trusted advisor team directory.

- User defined automated alerts (such as “Reminder, your quarterly tax payment is due in 30 days” ) and reports (such as “Here’s your updated Financial Snapshot”).

- User defined full or limited access to other trusted people, such as your CPA and estate attorney, so they have access to the information they need for their roles.

Coupled with telephone, email, chat, and soon, texting access to our service team (during business hours), clients have unprecedented access to the information and support they need TO GET THINGS DONE!

The Right WHO

As with many specialized details in life, the key to success is finding the right WHO – the right organization– to assist you in putting these tools, concepts and routines in place to achieve your desired results.

- If you are a high-net-worth investor (portfolio $1 million to $20 million) or ultra-high net worth investor (portfolio $20 million to $200 million),

- You have individual, retirement, trust or foundation assets you want managed, and

- You are looking to work with fiduciary (who has to do what is in your best interest), fee-only (no sales of products or earning of commissions) and relationship oriented advisory team

- who can help you with your financial, investment, retirement and estate planning and management needs,

- we may be a great match for you here at Janiczek Wealth Management.

Whenever you are ready to look into this further, just call us at 303-721-7000 (or fill out the simple form below) and we would be glad to begin the confidential conversation.

Download Janiczek’s Most Popular Guides

While you will likely hire us to handle most of the details, it never hurts for you to become more aware of the important concepts, tools and techniques used to achieve certain financial planning, retirement planning, portfolio management or wealth management objectives. This is why we are offering FREE guides at no cost or obligation to you.

Use the guides as a resource for yourself and… when the topic comes up in conversations with colleagues and friends…

let us know and we’d be happy to give you a copy to give to them.

For more Informative Guides click here

Want to Discuss Your Situation?

A simple conversation with one of our advisors may help you best sort out your needs and next steps. We’d be happy to confidentially chat with you. Just let us know when you are ready.

Call Now: 303-721-7000. Or submit request: